Multifamily Loan Crisis Looms

The math is pretty clear. Any multifamily loan originated at interest rates of 2 to 3% is facing a major refinance challenge. Let's look at the math for a hypothetical example.

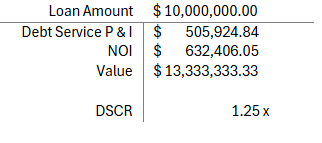

Assume that the interest rate was 3% and that the amortization was based on a 30-year schedule. Further assume that the loan started with a 24-month construction period followed by a five-year amortizing loan. Let’s also assume that the original capitalization rate was 4.75%. Here is a snapshot of the results for a $10 million loan:

Legacy Loan Example

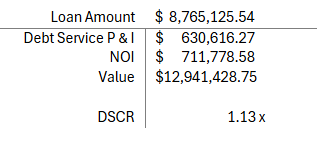

Now, let’s see what the refinancing terms look like assuming that the loan balance has been amortized during the last five years of the loan and further assuming that the NOI has grown 3% annually and the new interest rate is 6%. And let’s not forget the capitalization rate increase to 5.5%. Here is a snapshot of the results:

Refinance Loan Example

To achieve a 1.25 DSCR with the above NOI of $711,778.58 would require the loan amount to be reduced to $7.914,579.91. In other words, the borrower would need to fund $850,545.63 of fresh equity even though the loan balance now represents 68% of value versus 75% for the legacy loan.

While this may not seem all too bad it is a generic example of the impact of interest rate shock that is going to impact billions of dollars of multifamily loans, many of which are on bank balance sheets. Many loans were originated with higher loan to value ratios, and many were structured with generous interest only provisions. Moreover, operating costs such as insurance and labor have increased at a more rapid pace than rents in the past few years. Fuse that with rent concessions that are a staple of many urban markets, and the math gets even worse.

Regulatory guidance has given the banks quite a bit of leeway if the borrower/sponsor is cooperative and prepared to work with the bank, though in most cases the borrower/sponsor will be working with the banks’ special assets representative and not the original loan officer. If the property has positive cash flow, it’s even better for the borrower/sponsor.

The possible bad news is that banks who are overweighted to commercial real estate loans in general are going to feel pressure to sell loans to unclog their balance sheets. In rare instances the borrower/sponsor may be offered a discounted payoff option, but most banks find this avenue distasteful versus selling to a disinterested third party. The foreclosure route is the action of last resort and is typically reserved for situations where the underlying collateral has potential value, but the borrower/sponsor is incompetent or dishonest.

There is no doubt that a reckoning is coming; it’s just a case of when.

By Christophe P. Terlizzi, Principal, Associated Real Estate Consultants

Information about Associated Real Estate Consultants, LLC

AREC (www.Assocrealestate.com) Is a fully integrated, multi-disciplinary team with unmatched expertise in real estate finance, capital strategies, and portfolio management. Let AREC help you with your distressed CMBS or other commercial real estate debt. Our years of experience spanning multiple financial crises can help you engage with your special servicer or special assets lender to provide you with negotiating leverage aimed at optimizing your outcome.